The author has been working in the water purification industry for 35 years. As much as 90% of his business is exports to a total of 54 countries. He has travelled to 87 countries and about 45% of the time throughout the year he is on the road visiting clients; participating in tradeshows and marketing campaigns; understanding overseas markets; and attending meetings and conferences. The author stays on top of the water purification equipment market and trends in different countries and bring back water samples from all over the world for testing in Taiwan. The results are incorporated in the report and analysis of water quality in different countries. The author’s report and market analysis of 18 countries is freely available for downloads at https://ppt.cc/fzKJ2x.

When visiting different countries, the author explores different channels for distribution of water purification equipment (such as department stores, hardware stores, consumer electronics shops and chain stores for water purification equipment). He also visits clients in different countries. These clients include importers, wholesalers, retailers, and manufacturers of water purification equipment. The information obtained from discussions and business dealings with buyers around the world should ensure the objectivity of the market intelligence.

In this report, the author starts with the introduction of the 12 hottest markets for water purification equipment. The discussion is anchored on OEM/ODM players in the water purification equipment industry. This is followed with a detailed coverage and analysis of B2B companies. There are also objective recommendations to readers.

The main contents are as follows:

- Advice for investments in these countries

- Buying from the right markets

- Markets with the most competitive OEMs

- Suggestions for new brands to enter these markets

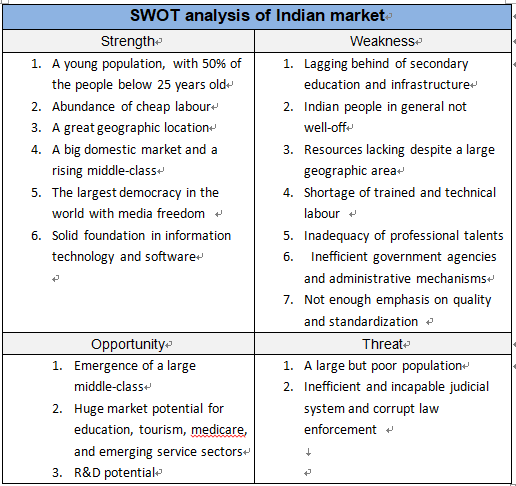

- SWOT analysis for different markets

- Forecasts for 2020 and beyond

- Competitive OEM products in different markets

- Tips for doing business in certain emerging markets

- Global M&As in the water purification equipment market

- Local and foreign brands active in different markets

Table of Contents

I) Global Water Purifiers Market Size

II) Global Supply Chain of Home Water Purifiers

III) Types of Home Water Purifiers

IV) OEM/ODM Qualifications and Characteristics in the Water Purifiers Market

V) Markets with Qualified OEM/ODMs for Home Water Purifiers

VI) Hottest Markets for Water Purification Equipment

VII) Conclusions

I. Global Water Purifiers Market Size

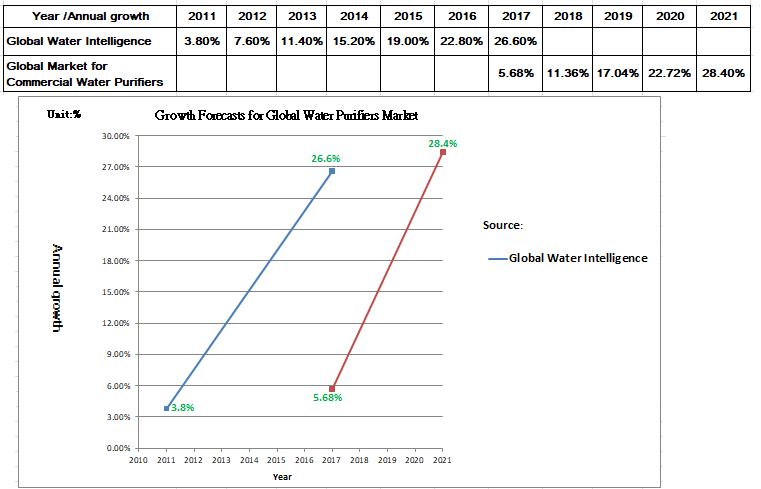

Numbers from the UNICEF (United Nations Children's Fund) and World Health Organization (WHO) suggest that about 663 million people in the world do not have access to clean drinking water. The safety and quality of drinking water is extremely important to both governments and the public. This is the reason for the growing attention to water purifiers. According to the report “Forecasts and Opportunities for Global Water Purifiers: 2018”, the market size increased at a CAGR of about 10% in 2013-2018.

Meanwhile, the commercial market of water purifiers is also significant. The report “Global Industrial Water Purifier Market 2017-2021” forecasts a CAGR of 5.68% for the market in 2017-2021.

The survey by Global Water Intelligence estimated the global water resources market at US$539 billion in 2013. It grew to US$586.3 billion in 2018, at a CAGR of 3.8% for 2011-2018.

The above statistics indicate the continuous and fast growth of the water purification equipment market.

II. Global Supply Chain of Residential Water Purifiers

Almost all the manufacturers in the global supply chain of water purification equipment are engaged in horizontal division of labour, to achieve higher production efficiency and industry specialization, to mitigate over-investments, and shorten development leadtimes.

As long as 17 years ago, there were a few well-known and successful industry alliances in Taiwan. These alliances have made contributions to their industries in Taiwan. In addition to regular company visits, they also share knowledge in new products, new materials, and new technologies. They publish research findings and drive industrial upgrades across the value chain. The most successful alliance is A-Team, Taiwan Bike Association. It was the benchmark for all the industry alliances in Taiwan. The following is an analysis on the success of A-Team.

In 2003, the founder of Giant and the founder of Merida proposed to work together in response to the exodus of the bicycle companies in Taiwan and the continued decline in exports. Industrial hollowing-out looked like a real possibility. At that juncture, they invited 11 suppliers to establish A-Team, Taiwan Bike Association. The alliance introduced management tools such as TPS (Toyota Production System), TQM (Total Quality Management) and TPM (Total Productive Maintenance). Member companies visited each other for sharing. This co-competition model accelerated the industry’s growth as a whole.

A-Team was formed when many bicycle companies in Taiwan moved overseas. It was also the time when the global bicycle industry witnessed a shrinking market size. However, with the leadership from A-Team, the Taiwan bicycle industry survived the global financial crisis. Ten years on and in 2014, the average selling price of exported bicycles in 2014 was 306% higher than in 2003. During this period, the export value of bicycles went up by 295% and the export value of components increased by 363%. This has put Taiwan at the forefront of the global bicycle supply chain.

The water purification equipment industry in Taiwan established W-Team in 2015. It was initiated by Fluxtek and joined by over 10 companies across the domestic supply chain, from OEMs to ODMs. This has contributed to the gradual development of the supply chain, with the ambition to become the largest OEM country in the world. Member companies include manufacturers of parts and components such as booster pumps, transformers, plastic injection moulds, activated charcoal powder, filter cartridges, and seawater desalination.

Below is a snapshot of the supply chain distributions of competitive components and materials in the global water purification equipment industry:

- Turkey: In-line filter cartridges, filter housings, plastic injection moulds

- U.S.: deleading agent, materials for heavy metal removal, reverse osmosis (RO) membranes, LED UV disinfection lamps

- Iran: polypropylene pleated (PP) filter cartridges

- China: reverse osmosis (RO) membranes, RO pressure tanks, PP) filter cartridges, carbon block filters, booster pumps, quick couplings

- Taiwan: RO pressure tanks, booster pumps, gooseneck faucets, water separators and other non-iron metal components, electronic control, quick couplings, LED UV disinfection lamps

- Korea: hollow fiber ultrafiltration (UF) membranes, vitamins (specially for shower filters to remove chlorine), quick couplings

- Japan: calcium sulfite (specially for shower filters to remove chlorine), activated carbon fibres, hollow fiber ultrafiltration (UF) membranes, electronic control

III) Types of Residential Water Purifiers

Residential water purifiers are divided into the purifiers for drinking water and the purifiers for non-drinking water.

1. Purifiers for drinking water

1.1. UV disinfection

The wavelength of UV disinfection lamps comes in the 250nm~260nm range and serves as great germicidal effects. This wavelength destroys chromosomes and achieves photochemical reactions.

The tubes of UV disinfection lamps are made of quartz glass. As the price of LED UV disinfection lamps continue to fall, their useful lives are longer than quartz glass and the design is more compact, LED disinfection lamps will replace the UV disinfection lamps (made of quartz glass) soon. Both models boast 99.99% bactericidal activity, and the treated water is safe to drink.

2. Hollow fiber ultrafiltration (UF) membranes

This type of filters works by forcing water through a semipermeable membrane, at a pore size of 0.02~0.1um.

3. Ceramic water filters

The filter works as a siphon, typically made of diatomaceous earth with ceramic sintering. The filtering efficiency is high, both the production cost and the energy consumption are low. The pore size of a ceramic filter is typically within 0.1um, sufficient to filter out bacteria and make water safe to drink.

Ceramic filters are used outdoors and popular among mountain hikers. They are easily cleaned for repeated use.

4. RO (reverse osmosis) water filters

RO (reverse osmosis) water filters treat raw water (with a physical method) and produces purified water, without any additive. There are two types of RO water filters: one for home use, and the other for laboratory use. The latter can meet the laboratory requirement for purified water.

RO can achieve desalination rate at 94-98%. It can remove calcium ions, magnesium ions, bacteria, and heavy metals, to make drinking water.

High-volume RO water purifiers have been taking the Chinese market by storm over recent years. This type of systems uses residential-grade membranes with an output of 500-800 gallons. This saves the cost and space required for water storage tanks and avoids the problem of secondary pollutants. The water output is large enough to ensure freshly purified water for drinking.

5. Purifiers for non direct-drinking water

5.1 Water filter jugs

The filters are typically made of ion-exchange resins and activated carbon. Better ones use the low-sodium version of ion-exchange resins and silver-impregnated activated carbon (to suppress the growth of bacteria).

5.2. Activated carbon water filters

They come in designs on-the-counter, below-the-sink, or at-the-faucet. The filters are made with activated carbon.

5.3. Water softeners

Water softeners usually use ion-exchange resins. The whole-house design uses positive ions (usually sodium) in the resins to exchange calcium and magnesium in water for softening purposes.

The exchange capacity of iron-exchange resins is limited. Once it is close to saturation, it is necessary to use salt for regeneration to restore exchange capacity.

IV) OEM/ODM Qualifications and Characteristics in the Water Purifiers Market

There are few markets with qualified OEMs working for global brands. To win orders from leading brands, OEMs and their local supply chains must have the following capabilities:

- The supply chain for water purification equipment in the country should be comprehensive. This ensures fast deliveries, prevents the increase of unit prices, and options for OEM suppliers.

- Quality of OEM products

- Willingness and ability to undertake low-volume, large-variety orders

- Fast deliveries

- Reasonable prices

- Respect and protection of intellectual properties for products/services in the country and by local players

Recommended reading: https://ppt.cc/fzKJ2x

V) Markets with Qualified OEM/ODMs for Residential Water Purifiers

Currently, only the OEM/ODM companies in Taiwan, Korea, China, and Turkey meet all the above-mentioned six requirements.

Strengths of companies in Taiwan: water dispensers, water purifiers, completely built units (CBUs) of water purifiers, parts/components, LED UV disinfection lamps, smart panels, metal components processing, plastics and rubber moulding

Strengths of companies in Korea: product design, RO membranes (from materials to finished goods), water dispensers, smart panels, plastic injections

Strengths of companies in China: RO membranes (reprocessing), water softeners, hollow fiber ultrafiltration (UF) membranes, metal components processing, smart panels

Strengths of companies in Turkey: plastic filter flasks, filter cartridges, water purifier casing, booster pumps, RO machine assembly

VI) Hottest Markets for Water Purification Equipment

The following 12 markets are the largest for water purification equipment. They are either big in size, price competitive, pioneers in technology, or have a comprehensive supply chain with government support. The author frequently visits these 12 countries and know well about these markets.

- U.S.

- Iran

- Malaysia

- China

- Korea

- Japan

1) Turkey

(1) Turkey as a troubled country

Newspapers and magazines are full of stories about the policy uncertainty of the Turkish government over recent years. Since the sovereignty adopted a presidential system, policy transparency and predictability has been reduced. This combined with dramatic depreciation of the Turkey Lira and a high consumer price index has weakened the confidence of investors. Both the current account and the financial account have been negative. The balance of foreign reserves dropped, and foreign debts as a percentage of GDP has gone up.

Although all news about Turkey is negative, the local market of water purifiers does not seem to be adversely affected by foreign debts, fiscal deficits, or COVID-19. An interesting data point is here: Company A in Turkey has purchased a total of 175,080 RO pressure from Taiwan from December 2019 to August 2020. The Turkish market for water purifiers still shows great potential.

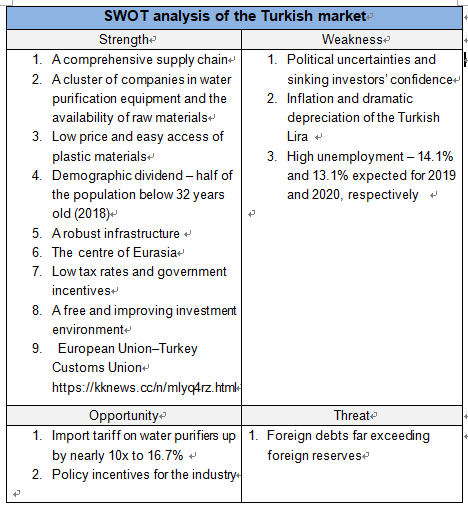

(2) SWOT analysis of the Turkish market for water purification equipment

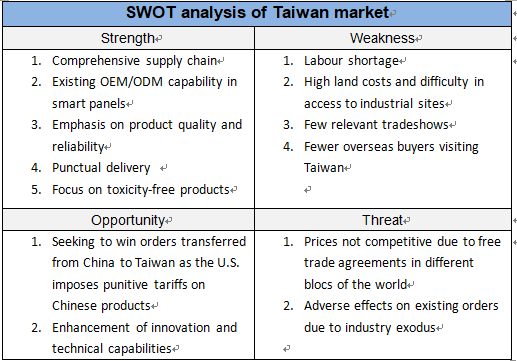

Below is a table for a SWOT analysis of the Turkish market for water purification equipment. The number of strengths is higher than the aggregate of weaknesses and threats. This suggests the rapid growth of the market for home-use water purifiers in Turkey.

(3) Key issues for entering the water purifiers market in Turkey

3.1 About investing in production facilities

Based on the above list of competitive advantages, the outlook for investment in production facilities remains positive.

There is no control in foreign currencies. Capital movement is free.

Turkey is the bridge between Europe and Asia. It serves as the springboard into Central Asia, Middle East, and North Africa.

Turkey is a member of the European Union Customs Union. This helps to enter the European market.

There is a cluster of supply chain companies in Turkey, so setting up production facilities will not be costly. It also ensures time to market.

Although prices are competitive, the demand for the standard RO purifiers remains strong in Turkey. Investments may be made in this segment.

3.2 Advice to new brands entering the market

To protect the domestic water purifiers companies, the Turkish government has raised the import duty from 1.7% to 16.7%. With over 40 domestic brands in this market and given the consumers’ behaviour in the home-use market, prices are the biggest consideration. There are also over 20 foreign brands in this crowded market. New entrants from overseas are advised to think carefully before making inroads to the Turkish market.

(4) Popular brands in Turkey

Domestic brands:

Hazar、ESLİ , Frizzlife, APEC, Express, Waterdrop, Simpure, Home Master, Brondell Circle , FS-TFC, Aquatic, Rinkmo, Geekpure, Hydro-Logic, PUCRT,Genuine, Yescom, AquaLutio, Watergeneral, Clear Choice,Global Water ,Puroflo, Nakii,ZeroWater,LifeStraw,AquaBliss,Epic pure, Fette,

WINGSOL, Hskyhan, WATEN, HOSUN, AquaFresh, CLEAR2O,

Aquagear, FROSTY H2O,

Foreign brands:

Brita, Whirlpool, RKIN, iSpring, Aquasana,Watts, AUGIENB,

LYUMO,Brio, aibileec,Pur, CuZn,LEVOIT,Culligan, GE,

LAKE,ESOW, Pure Source, Samsung, AO Smith

2) U.S.

1 History of the water purification industry in the U.S.

The U.S. water treatment industry in the U.S. took off at the inception of the National Sanitation Foundation in 1944. Seventy-six years on, the U.S. water treatment industry has been the world-leading pioneer, evidenced by its innovation of products and invention of filters.

2 Most stringent standard for drinking water in the world

The revision of the Reduction of Lead in Drinking Water Act (RLDWA) in 2011 reduces the maximum lead content on the wetted surfaces of plumbing products from 8% to 0.25%. The amended act also contains the statutory method for calculation of lead contents.

The revision of this act has increased the technical barrier for foreign products seeking to enter the U.S. market.

In addition, the National Sanitation Foundation has established a set of inspection standards for water treatment companies for homes, businesses, industries, and small communities. These standards have become a global benchmark.

Notes:

RLDWA: Reduction of Lead in Drinking Water Act

NSF: National Sanitation Foundation

3 Popular brands in the U.S.

Domestic brands:

ZeroWater, Pur, Frizzlife,

Nakii, Apec, , Glacial Pure, Waterdrop, Aquagear, Berkey, EpicWater, Aquabliss, Reshape,

Max Strength Pro, Brio, GE,

LEVOIT ,Everpure, Aquaboon,

Hskyhan , ExpressWater, Cuzn,

Whirlpool , Bosnell, Mountain Flow, Crystala Filters , Santevia, Culligan, Amway, Tupperware

Avalon, Soma, EHM ,

Frigidaire, Sawyer , Dimener , AquaHomeGroup,Aquasana,

AquaEarth, Elkay, EcoSmart, PureDrop, Pureza,

Apusafe, Filtrete, FilterLogic, Frigid➽ire,Aquatic Life, Perfect Water, Watts, LAKE,PUREPLUS , Seychelle , Nathan Craig, Anpean, Belursus, 3M, Clearly Filtered, Atalawa , Yarna, Waten H2O, Brondell, RIPURI, ESOW, Moen, SimPure, Vitapur, DuPont,

GOSOIT, Hima, Kraus,

InSinkErator, Survivor, Fette , InvisiClean, Filmtech, iSpring

Foreign brands:

LG, BWT, Katadyn,

Samsung, Dew Filters, Wingsol,

EcoSmart, LifeStraw, Aquacrest,

Brita

3) Spain

(1) Long-standing popular of RO purifiers in Spain

The Spanish cities along the Mediterranean suffer the problems of serious salinization of groundwater and river water due to sea water intrusion. The total dissolved solids (TDS) of water in these cities can be as high as 2500 ppm. The salt content in water remains high. City governments have to use RO filtered water blended with river water for supplies to residents. As a result, tap water charges are as expensive as €4 per cubic meters.

The “blended” tap water in the cities still has 350ppm to 550ppm in TDS. This is the reason why each household in Spain has to install small RO purifiers. The unique blending of water has made Spain a heavy user of RO purifiers. It is hardly surprising that this is a super competitive market.

Analysis of water quality in Spain:

https://ppt.cc/fQTeGx

(2) Key issues for selling home-use water purifiers in Spain

1 About investing in production facilities

The emergence of China has swept all the traditional industries in Spain, and understandably the home-use water purifiers industry is no exception. Spain has almost entirely relied on imports for its need of home-use water purifiers over the past few decades. This means a slim chance of success in setting up production facilities here.

Imported water purifiers in Spain come from the following countries:

1.1 Germany: about US$21.47 million

1.2 France: about US$13.97 million

1.3 China: about US$13.78 million

1.4 Taiwan: about US$12.96 million

1.5 U.S.: about US$10.10 million

2 Advice to new brands seeking to enter the market and M&As among heavyweights

The BWT group from Germany acquired the water purification business from Fluidra in Spain. This was followed with 50% stakes in Puricom Europe (formerly a joint venture between Ionfilter from Spain and Puricom from Taiwan) were acquired by Kinetico from the U.S. The other Spanish company Hidro water was worried that these two big companies would control the domestic market, so it decided to be 100% acquired by Culligan from the U.S. Currently, these three heavyweights dominate the Spanish market. It will be difficult for small brands to enter the market.

(3) Most important tradeshow in Spain for the water treatment industry is the biannual Smagua.

The next expo venue: Zaragoza, Spain

Expo dates: 2nd- 4th March 2021

Website: https://lihi1.com/1aMsr

3 Popular brands in Spain

Domestic brands:

Tapp, Spardar, YJHome, Osairous, Ecopure,

Waterdrop, Goeco, WinArrow,

Bestever, Geyser, H2O Taps,

Aqua Optima, Slickbox, Rowenta,Newdora, PowerDoF, TM Electron, Orinko, filterportal, iWater, Ghonlzin , Bestever,

Desconocido, GRIFEMA, Cadrim,

XREXS, Bbagua,, RUNACC,

ADOVEL, BETOY, GXHGRASS, Aigostar, CANALETAS, SILBERTHAL, Finerfilters, Haofy,

Fdit, Czxwyst, AIMIUVEI, KURO-Bō , Nrpfell, Enzege, CREA, Vibratis,

Foreign brands:

Brita, Geyser(Russian) Waterdrop(UK), BWT, Boston Tech (USA),AEG(Germany), Aquaphor(Russian),LaVie(France), MAURER(UK), baytiz(UK)

4) Iran

4.1 A special country

Iran is a special country. Because of its development of nuclear weapons, it has been economically sanctioned by the U.S. for years. There is no American style fast-food restaurants, American cars, bars, or cafes. The US dollars are not in circulation here, and Iranians cannot use international credit cards. There are no foreign currencies, and no other countries accept Toman, the Iranian currency. Doing business here relies on the local black market for US dollars, at an outrageously high fee.

4.2 Dramatic depreciation of the Iranian currency

COVID-19 wreaked havoc in Iran in February 2020. This shock brought the economy in Iran to its knees, again. The epic depreciation of Rial continued, into 3500x over the past 49 years. The long history of Rial, the Iranian currency, went to an abrupt end with the introduction of Toman in May 2020. The value of four zeros in Rial was converted into one Toman.

4.3 Recent developments of the RO water purifiers market in Iran

Until 2018, about 5 million RO water purifiers have been sold in Iran. Importers in Iran estimate that the market size has a potential of 15 million, assuming each household replaces its RO water purifiers every ten years.

4.4 Growth and trends of the RO water purifiers market in Iran

2000-2005

During these early five years, Aquajoy and Ronak were the only two brands active in the market.

2006-2010

About 10 brands were active in the market. This included Puricom and Watersafe.

2011-2012

These two years saw the number of brands in the market up to 25 brands (e.g. easywell, purepro and Fluxtek).

2013-2015

The market was crowded with over 50 brands by 2015 (including easywell, Puritec, and Masoumi).

2016-2019

The number of brands in the marketplace exceeded the 100 mark. Most brands are local players who process and assemble key components procured from China.

4.5 Economic difficulties in Iran

Despite the chronic currency depreciation, a depressing economy and high unemployment, the demand for clean drinking water remains strong. Iran is a heavy user of RO water filters, primarily imported from China and Taiwan. However, the Trump administration almost cut off Taiwan’s export of water purifiers (and of course other essentials) to Iran, due to complete blockage of flows of goods and capital.

The development of the water purifiers market in Iran is worth watching, given the continued economic sanction from the U.S. and the effect of the pandemic.

4.6 Popular brands in Iran

Foreign brands:

BOSCH、ALYA (Taiwan)、Puricom (Taiwan), Aqua Spring (Taiwan), Takoman (Vietnam), AquaPro (Taiwan), Aqua sol (Denmark), AquaSpring, Sole Aqua, AquaBlue (Egypt), Aqualife (U.S.)

Domestic brands:

UltraJet, MaxTec, Salamat Gostar Warsh, PureLine(Sahand Industries ) ,Aqua blue, Violet,

Soft Water, Tasfieh Sazan Mehr ,

4.7 Doing business in Iran

Almost all the buyers from Iran ask for credits. This may be how they do business or how they extend their own capital to infinity.

The author has encountered an Iranian client who asked for unreasonable cuts in pricing by using product quality as an excuse.

Content of this article is free to use, but please attribute the source.

Author: Rodger Lin, Easywell Water Systems Inc.

For more information, please visit https://ppt.cc/fbr7rx

5) Egypt

5.1 Heavy Contamination of the Nile River

Egypt is best known for its pyramids and the longest river in the world – the Nile River spanning 6,853 kilometres. This river is the cradle of the ancient Egyptian civilization and the main water source for the people of the desert state. As much as 90% of its population lives in the plains and the delta areas along the Nile river. The water for daily use and irrigation comes from this river of life.

As all the wastewater and garbage from factories and farms have been dumped into the Nile River for years, the pollutions in the downstream Greater Cairo Area are alarmingly serious. Some people even avoid eating freshwater fish and shrimps. The tap water has to be filtered and sterilized by local residents.

According to a 2016 report by the House Committee of the Parliament of Egypt, the water in 18 governorates was too polluted to be used for drinking. The survey by the National Water Research Centre (NWRC) indicates 17,000 children die of dysentery because of unhygienic drinking water over a long period of time.

Although the Egyptian government claims that the tap water is safe and clean, many families remain concerned. The affluent purchase bottled water for drinking.

Most of the water purifiers and components sold in Egypt come from China and Taiwan. The price competition is as fierce as in the Turkish market.

5.2 Doing Business in Egypt

The B2B clients in Egypt are known for the following characteristics:

1. Price orientation: They first look at the prices and then the quality. This is the reason why cheap water purifiers from China have swamped the market.

2. 80% buyers request A/A (documents against acceptance) for transactions, and most of them claim that this is a legal requirement.

3. They ask for exclusive distribution rights for all products before even placing the first order.

5.3 Bottled Water Market in Egypt

Nestle is the No. 1 brand of bottled water in this market. Other international brands include:

1 Pepsi Aquafina

2 Baraka (a Nestle’s sub-brand)

3 Dasani (a Coke Cola’s sub-brand)

There are also some popular local brands such as Aqua, Siwa, and Safi.

5.4 Water Purifiers Market in Egypt

Import data released from the Egyptian government suggests that 236,000 water purifiers were imported per annum by the country. About 25% of the imported purifiers are for home use. This is obviously a market with huge potential, particularly for RO (reverse osmosis) filters with five to seven stages. However, prices remain the key consideration.

5.5 Water Equipment Tradeshow in Egypt

Expo name: WatexExpo

Expo period: 11/1-11/3 2020

Website: https://www.water-filter-manufacturer.com/

5.6 Popular brands in Egypt

Domestic brands:

Maxsome, Tango, Tank Power,

Zoosen, Hi Tech,Aqua Jet, Aqua Trex, Soul Water, Lockk & Lock

Generic, Universal, Moma, Blu,Uno, Konka,

Foreign brands:

Panasonic, Brita. Culligan, Sprite, CCK, FreshWater (UK)

6) Malaysia

(1) The demand for water purification equipment is high in Malaysia because 186 rivers are mildly polluted, and 43 rivers are severely polluted in the country according to an environment report. In addition, there are contamination risks associated with the transport of tap water via underground pipes to homes. Therefore, water companies do not encourage direct drinking of tap water. Malaysian people have to use water purifiers to treat tap water. In other words, water purifiers are an essential part of life in Malaysia because most people rely on water purifiers for safe drinking water.

(2) Channels for selling water purifiers in Malaysia

There are mainly four channels:

1 Ecommerce platforms

The top five ecommerce platforms in Malaysia in 2019 are as follows:

1.1 Shopee: 28.38 million visits

1.2 Lazada: 18.39 million visits

1.3 Lelong: 2.05 million visits

1.4 Zalora: 1.33 million visits

1.5 GoShop: 0.85425 million visits

2 Specialist shops

Most water purifier brands set up their own shops in Malaysia. It is believed that specialist shops foster consumers’ confidence. As long-term maintenance and filter replacements are required, consumers are convinced that the presence of brick-and-mortar speaks of the commitment for long-term business.

3 Shopping malls

Below is the list of the top five shopping centres in Malaysia.

3.1 Sunway Pyramid Shopping Mall

3.2 Pavilion KL

3.3 KLCC

3.4 Mid Valley Megamall

3.5 Bukit Bintang

4 Multilevel marketing and direct selling

There are over 500 registered multilevel marketing and direct selling companies in Malaysia. Water purifiers are a must-have product for any multilevel marketing and direct selling system, as long as the products are differentiated. Also, these marketing and direct selling firms like to label their products as “functional water” such as hydrogen-rich, π-WATER, energy water, alkali ion water. The direct selling channel is likely to account for a significant portion of the market.

(3) Best-known trade show in Malaysia:

Asiawater Expo & Forum

Expo dates: 11/30 - 12/02 2020

Venue: Kuala Lumpur Convention Centre

https://www.water-filter-manufacturer.com/

(4) The water purification equipment industry in Malaysia has a long history. The first company is probably Ultra-Super, whose founder Mr. Johnny Huan made a fortune by distributing Doulton ceramic filters. Many competitors joined the market mostly as multilevel marketing and direct selling companies. Examples are Nesh, Diamond, Seiketsu, Cosway, Amway, Tupperware, etc. The production and marketing of water purifiers in Malaysia is predominately the distribution model of foreign brands. Few players invest in R&D and manufacturing. Companies such as Nikom and Pureflo mostly produce components such as filter cartridges and housing.

(5) Key issues for selling home-use water purifiers in Malaysia

1 About investing in production facilities

Malaysia is a major agricultural producer, with many coconut trees, palm trees, and rubber trees. The use of coconut shells and palm kernel shells to produce activated carbon is relatively advantageous. However, there is a lack of supply chain support and the manufacturing of water purifiers will be challenging. Four or five companies from Taiwan went to Malaysia to set up production facilities, as they were bullish on the local market potential. However, they all closed business within ten years.

2 Advice to new brands entering the market

Brands from other parts of the world have entered the competitive market of Malaysia for a long time. They either seek local distributor or set up subsidies in Malaysia. These brands come and go. Some have failed, but others were successful.

Better known foreign brands:

Doulton ,Panasonic, 3M, Coway, Cuckoo, Everpure, Watpure, Aquasana, Augienb

(from Hong Kong), SK Magic, Multipure

Domestic brands:

Nesh, Diamond, Seiketsu, Joven, Aquaman, Waterman, Filterman, Instar-life, AMG,MDBC,

2020 08 10

Content of this article is free to use, but please attribute the source.

Author: Rodger Lin, Alya Water / Easywell Water Systems Inc.

Table of Contents :

7). Vietnam

7.1 A significant player in the global water equipment market

Vietnam has a population of 95.54 million, with 70% of people below the age of 35. The advantage in its labour force is obvious. More importantly, RO membrane water purifiers have become a home necessity over the past decade, and the market has been booming. This underpins the vibrant development of the industry.

7.2 Drinking water as a pain point for Vietnamese people

Water source pollutions and tired old pipes are the two major reasons for poor quality of tap water in Vietnam. In Ho Chi Minh City, drinking water comes from the Saigon River but 800 factories emit industrial wastewater into the river every day. Meanwhile, urbanization has been happening too fast in this city for water pipes to catch up. Stale and rusted iron pipes have been a source of pollutions for tap water.

In the past when tap water was not drinkable, Vietnamese citizens purchased bottled waters. However, urbanization has dramatically changed the family structure and more and more youngsters have been moving to cities and living as small families. The demand for large bottles of water has gradually declining. The emergence of scandals on bottled water also undermined consumers’ confidence in the safety and quality of bottled water. As a result, they looked for alternatives.

7.3 Selling prices of home-use water purifiers in Vietnam

The decline of the bottled water market made water purifiers a rising star. There are currently two types of water equipment in the Vietnamese market. One is low-priced “purification buckets”. It is essential a plastic bucket plus a faucet. The water is filtered with activated carbon, mineral stones, resins, and ceramics. A purification bucket is selling at slightly over US$100. The other product category consists of premier RO purifiers and UV disinfection purifiers with three to seven filters. The selling prices range between US$130 and US$250.

High-end water purifiers are mainly sold in home appliance shops and membership-based hypermarkets. Most of the brands are Vietnamese.

Meanwhile, the combination of water purification and dispenser is hugely popular in Vietnam. Both simple and inexpensive products and high-end options costing US$200 to US$280 can find customers. The middle-class consumers in Ho Chi Minh and Hanoi purchase water purifying jugs (or buckets) in large malls and supermarkets. Meanwhile, TV remains a powerful media, as the key channel for consumers to learn about product information.

7.4 Strong online sales

In Vietnam, 54% of the population has access to the Internet. The Internet coverage in Ho Chi Minh and Hanoi is not low. Most cafes and restaurants in the cities provide free Wi-Fi. As a result, online marketing has become increasingly mainstream. More and more companies are selling home-use water purifiers via ecommerce platforms or their own websites.

Below is the list of the five most popular ecommerce platforms in Vietnam.

1. Lazada.vn

2. Chotot.com

3. tiki.vn

4. Thegioididong.com

5. Amazon.com

7.4 Up-and-coming commercial market for water purification equipment

Cafes, beverage shops, American fast foods and ice cream stores have seen rapid growth in Vietnam over recent years. To ensure the safety of beverages, most stores use commercial-grade water purifiers. Of course, this is a market with great potential.

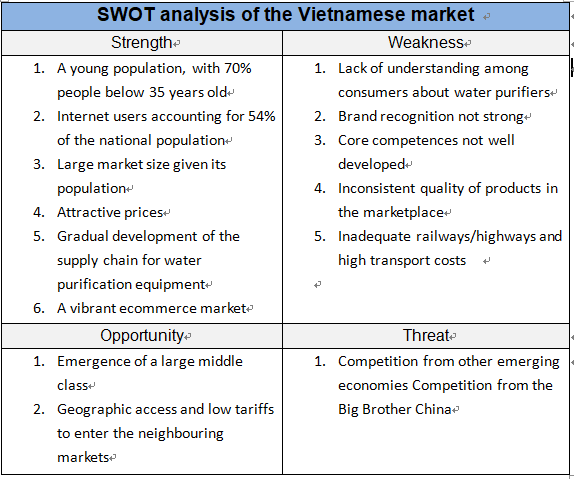

7.5 SWOT analysis of the Vietnamese market for water purification equipment

7.6 Key issues for selling home-use water purifiers in Vietnam

1 About investing in production facilities

Vietnam is the rising star, after the emergence of China. Companies from different countries have rushed to Vietnam. Even the Chinese players have moved to Vietnam. Meanwhile, the development of home-use water purifiers market in Vietnam over the past decade has contributed to a healthy supply chain. The domestic market is huge, given its population of over 90 million people. If this is not enough and you have resources, you can sell to other South Eastern countries.

2 Advice to new brands entering the market

Foreign brands:

AO Smith, Coway,Xiaomi, Unilever Pureit, Sharp, Toshiba, BWT, Brita,ALYA

Domestic brands: Tecomen,Tana,Sonha ,KoriHome,Comath,Kangaroo,Karofi,

Eurolife, Goodlife, NanoRobo, Sunhouse, Geyser, Fujie , Nagakawa, Vasstar, Pureworld, Aqua

The above is a snapshot of domestic brands and foreign brands in Vietnam. New brands or small brands should still have a fighting chance in this market.

Data about water purifier brands in Vietnam:

https://ppt.cc/foh4tx

Vietnam has been successful in keeping COVID-19 at bay. Whilst its economy was affected, it bounced back quickly. Vietnam may become one of the few countries with GDP growth this year. The outlook for the water purifiers market should also be positive.

8) China

8.1 Drinking water habits in China

There are over 400 million families in China but less than 5% of them have ever owned water filters. They usually prefer water dispensers that give both cold water and hot water. The retail price of a water dispenser without filtering functions is US$43~72. Most people simply order clean water at a five-gallon water refill for the dispenser. Some companies in China build in filtering functions into water dispensers, so that (1) users no longer need to order refills; (2) water dispensers with filtering functions can be sold at a higher price of US$144-215 at the retailer’s end.

8.2 Source of imported water purifiers

According to the data from the General Administration of Customs of the People's Republic of China, the top five countries of origin of water purifies imported by China are as follows:

1. Korea 21.18%

2. Germany 19.62%

3. U.S. 10.27%

4. Taiwan 6.24%

5. Japan 5.14%

8.3 RO membrane market in China

China is the world’s largest RO membrane market, currently at a market size of about 500,000 roles and a growth of 10% expected per annum. The R&D and successful mass production by China over recent years have caused a collapse of the RO membrane prices in the global market. The wholesale price of a 50-gallen role was US$7-US$10 ten years ago. It is now US$3-US$5 per role made in China.

8.4 Trends of the water purification equipment market in China

The water purifiers market in China over recent years has showed the following trends:

1. Intelligence of water purifiers

2. Modularization of completely built units of water purifiers

3. Large-capacity and outputs for RO purifiers

4. Dual-function or multi-function filters

5. Installation not required

For more information, please visit https://ppt.cc/fmPdmx

8.5 Product certifications for water purification equipment sold in China

The compliance of local laws and regulations is required to sell water purifiers in China. There seems to be a long queue in the application for the approval of safety and health of drinking water products. Perhaps there are too many suppliers eager to enter the water purifiers market in China. A wait of two to three years for the approval is commonplace.

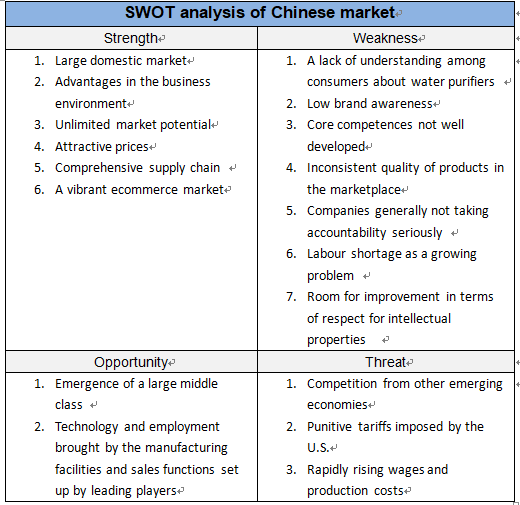

8.6 SWOT analysis of the Chinese market for water purification equipment

8.7 Marketing models in the water purification equipment market of China

There are about 8.8 million households categorised as the rising middle class in the cities. A 60% penetration implies a market size of 5 million water purifiers and the corresponding market for consumables such as filters per annum. Currently, home appliance chain stores and shopping malls remain the key channel for distribution of home-use water purifiers in China.

Alternatively, retailers in Tier 1 cities such as Beijing and Shanghai typically rent make-shift booths at the entrance to communities at a lower price to market water purifiers.

8.8 Prediction for water purifiers market in China

China Market Monitor Co., Ltd. in Beijing forecasts the water purifiers market in China to grow at a CAGR of 45% in 2015-2020 and exceed US$18.4 billion by 2020. However, this forecast may need to be revised downward given the COVID-19 pandemic and floods along the Three Gorges of the Yangtze River.

8.9 Consideration for purchase of water purifiers in China

According to a survey by China Household Electrical Appliances Association (CHEAA), the top considerations for consumers in the purchase of water purifiers are as follows:

- Filtering technology and methods (76%)

- Filter replacement cost and frequency (59%)

- Brands (57%)

- % of wastewater (43%)

- Reminder for filter replacements (42%)

- Cost/performance ratio (42%)

- After-sale services (26%)

8.10 Key issues for selling home-use water purifiers in China

1 About investing in production facilities

The likelihood of success for foreign companies to set up manufacturing facilities in China is nothing comparable from the past. Production costs in China are much higher than those in South East Asian countries. Even Chinese companies are moving to South East Asia because they cannot afford the rising manufacturing costs in China. Also, the trade war between China and the U.S. does not seem to have an end. It is no longer viable to invest in production facilities in China.

Advice to new brands entering the market

Almost all the water filter brands from other parts of the world are already in China. It is a bit too late for any new entrants to develop the Chinese market.

8.11 Popular brands in China

Foreign brands:

3M, Everpure, AO Smith, BWT, Coway, Brita, Doulton, Philips, Panasonic, Toray, Amway, Mitsubishi, Franke,Pureit, Laica ,LG, GE, Honeywell, Lux, Watpure, Toppuror,Paragon,Eco-water, ALYA, Pentair ,Atlas, Bosch, Culligan, Rinnai, Tupperware, Sakura

Domestic brands

Angel, Midea, Haier, Litree, Qlife, Xiaomi, Canature, Hunsdon, TRULIVA, Sun Rain, GREE, TCL, KEMFLO, Joyoung

9) Taiwan

(1) Current status of the water purifiers industry in Taiwan

The water purifiers industry in Taiwan started in the 1970s and rapidly grew since the 1990s. In the early days, the industry focused on processing and assembly activities in the midstream. Almost fifty years on, the industry continues its pursuit of materials and components in the upstream and sales and services in the downstream. Up to the present, there are about 300 companies in Taiwan forming a comprehensive supply chain, with 25% of the players involved in material manufacturing and trading in the upstream, 25% in assembly activities of the midstream, remaining 50% sales and distribution in the downstream.

(2) Complete supply chain in Taiwan

The water purification equipment industry in Taiwan covers all the value chain activities, from upstream, midstream to downstream, equipped with core knowhow in the filtering technology, R&D and innovation, industrial design, production & assembly, quality control, OEM/ODM, to sales and distribution.

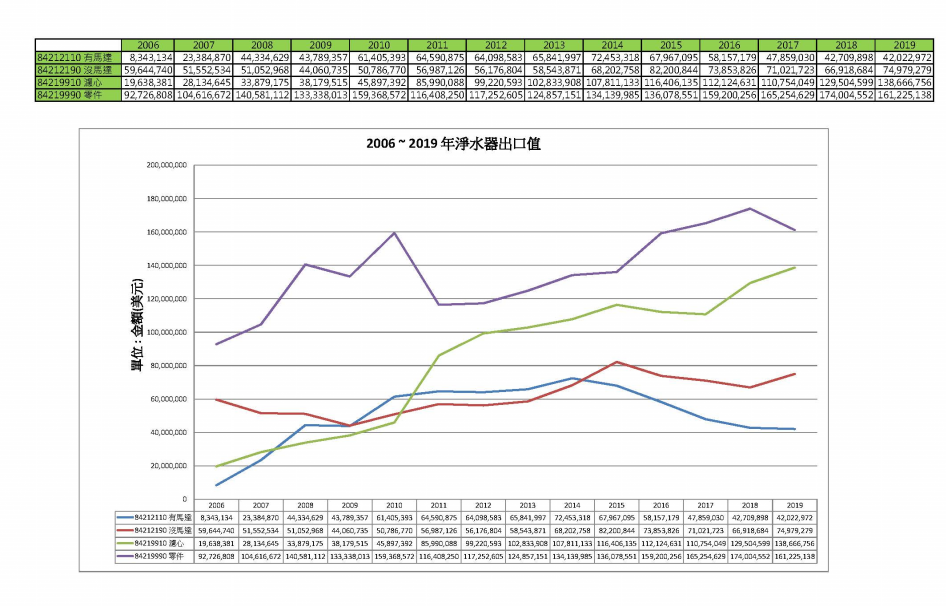

(3) Continued growth in Taiwan’s export of water purification equipment

The export value of water purification equipment increased from US$180 million in 2006 to US$417 million in 2019, a growth of 2.32x during the period of 13 years. These numbers demonstrate the competitiveness and potential of water purification equipment for home use made in Taiwan.

Below is a list of data for the water purifiers market.

Taiwan is the best option for outsourcing partnerships when it comes to home-use water purifiers.

Water purification equipment is an industry with unlimited potential.

The global competition will only intensify.

Source: Import/export statistics from the Bureau of Foreign Trade of the Ministry of Economic Affairs

(4) Abundance of basic materials for water purification equipment

Taiwan’s technology in performance textiles is a source of high-quality and price-competitive filters for water purification. Taiwan’s strengths in smart panels and electronic engineering are the key to the upgrade of home-use water purifiers.

In the 1990s, many industries in Taiwan moved to China to set up production facilities. The water purifiers industry was no exception. This includes companies such as Multiply, Kemflo, KSW (King Sky Water), Hantech, ACUO, and Deng Yuan.

After the trade frictions between China and the U.S. under the Trump administration, manufacturers doing business into the U.S. have been accelerating their exodus from China to avoid punitive tariffs and weaker competitiveness. The income per capita in China has increased from $900 to over $9,000 over the past two decades. The manufacturing costs in China has also been rising. As a result, the water purification equipment makers from Taiwan are returning home or move to South East Asia.

(5) SWOT analysis of the Taiwanese market for water purification equipment

(6) Forecast for the water purification equipment market in Taiwan

The incident of lead water pipes in October 2015 triggered concerns for water safety. In addition, food safety problems emerged one after another. As a result, the market size in Taiwan reached NT$2.85 billion in 2016, up dramatically by 21% from 2015.

It is expected that more than 87,000 under sink filters will be sold during the year, with the market size totalling US$4.5 million.

(7) Electronics heavyweights set eyes on the high growth of the water purification market

It seems everybody in Taiwan realizes the potential of the water purifiers market. Many listed companies join the bandwagon by investing heavily in the development of filter materials, design of complete units, research of LED UV disinfectant lamps, and functional water materials. Marketers are also looking for manufacturers for outsourced production.

Some of the big names are as follows:

- NKFG Corporation (a member of the Formosa Plastics Group)

- Innolux

- OPPOTECH

- Micro-Star International

- AU Optronics Corporation

(8) Key issues for selling home-use water purifiers in Taiwan

1 About investing in production facilities

The profit margin is declining in the home-use water purifiers of Taiwan. The domestic market is simply limited. Although the supply chain is comprehensive, most companies rely on exports for over 90% of businesses. Meanwhile, there is a shortage of factory operators, the land cost is high, and the environmental protection laws and regulations are increasingly stringent. Investing in production facilities in Taiwan at this point in time does not seem to be a good idea.

2 Advice to new brands entering the market

There is a long list of brands in the water purifiers market of Taiwan. The advertisements of well-known international brands are everywhere. The Taiwanese people can accept good quality, slightly more expensive products from overseas.

Foreign brands:

3M, Everpure, AO Smith, BWT, Coway, Brita, Doulton, Philips, Panasonic, Toray, Amway, Mitsubishi, Franke,Pureit, Laica, LG, GE, Honeywell, Lux, Watpure, Toppuror, Xiaomi

Although the competition continues to intensify, it is not yet too late for new entrances to enter the Taiwan market with differentiated products, correct positioning, and precise marketing strategies.

Domestic brands (with own factories, channels, and brands):

ALYA, CHANSON, Water Nice, ACUO, Great Idea, Yen Sun Technology, Sakura, Buder, Hao Hsing

Content of this article is free to use, but please attribute the source.

Author: Rodger Lin, Easywell Water Systems Inc.

For more information, please visit https://ppt.cc/fzKJ2x

10) Korea

(1) Snapshot of the water purifiers market in Korea

Before 1997, the water purifiers market in Korea was dominated by multilevel direct sellers. The momentum for continued growth was underpinned by a vibrant leasing market.

There are over 100 manufacturers of components and complete units of water purifiers in Korea. These companies are capable of developing new products and they share information, so that they can develop products with interchangeable parts/components.

(2) Leasing market still hopeful in Korea

There are two changes in the water purifiers market of Korea: (1) large water dispensers gradually becoming compact, with filtering functions; (2) leasing market continuing to grow.

(3) Functional water purifiers popular in Korea

Korean people wanted to have clean and safe water. Now they pursue functional water that is beneficial to health. To meet this demand, companies are starting to produce water purifiers that provide carbonated water, pure water for coffee making, hydrogen water, alkali ion water, and energy water.

The Korean market for water purifiers is dominated by UF (ultra-filtration) products, accounting for 55% of the market. Most of this 55% is sold via leasing. RO products have the remaining 45% market share.

The filtering method is gradually shifting from four to five filters to two to three filters, as filtering functions are integrated.

The Korean government authorizes the Korea Water Purifier Industry Cooperative (KOWPIC) as the regulator for the market by conducting quality inspections and conferring quality certifications to water purification products.

(4) Development of functional water filters in Korea

Both Korea and Japan saw a relatively early development of functional water. There are numerous manufacturers of hydrogen water purifiers, such as Ioncares, Ionvida, Magiccos, and Paino. The producers of materials for alkali water and vitamins for dichlorination are also competitive.

(5) Key issues for selling home-use water purifiers in Korea

1 About investing in production facilities

Korean manufacturers of components for home-use water purifiers are competitive. Handok and Altwell produce carbon blocks; Polymem, Toray, CSM and Para UF filters; DM Fit, KQ and McCoy push-in fitting of quick couplings. Korean vendors are of high calibre in design, production, assembly, and marketing. This combined with high wages makes it unlikely to enter the market by setting up production facilities unless you go for full automation.

2. Advice to new brands entering the market

The patriotism of Korean people is evidenced by their love for Korean products. This may be changed easily. It will not be easy for any new brand to make inroads into this market.

Popular brands in Korea

Foreign brands: Brita, Everpure, 3M, Laica, Calligan, BWT, Philips,Jet soda Stream (from Israel)

Domestic brands: Pureal, Sejin Aqua, Waterpia, Claro, Ruhens, Hyundai, Wonbong, Filtertech,Wells, LG, OKwater, Coway,COMS, OKO, KC, ICEVAN,Cuckoo, SK Magic

11) India

11.1 Demographic dividend

The average age of the Indian people is only 29. Those below 35 years old account for 65% of the population. Those above 65 years old are only 5% of the population. These numbers speak of the demographic dividend in India.

11.2 Drinking water quality in India

Anybody who has been to India will know not to drink the water from the tap ever. Even eating the fruits washed with the tap water will end up with diarrhoea. The sight of local people gulping water cannot help people wonder how to they never get sick.

The study from Water Aid, an international non-profit organization, suggests that the quality of water in India is the worst in the world. The Indian people are not immune to poor-quality water. Tens of millions of people fall ill each year from drinking polluted water. The number of child deaths caused by poor water quality is hundreds of thousands.

Poor quality and scarcity of water in India naturally leads to demand and attracts continued investments from both public and private sectors, hoping to resolve this essential problem.

Whilst everybody was aware of the water quality problem, not all consumers in India could afford water purifiers. Local people mostly resorted to two methods: (1) drinking cooled water after it has been boiled; (2) use of simple tablets to purify water.

However, Indian companies have been working over recent years with global heavyweights to gradually reduce the prices of water purification equipment. As a result, the penetration of water purifiers has gone up in the middle-class households. To deal with water scarcity, these purifiers come with large capacity in storage, so that consumers will have water in case of supply disruptions.

A 2011 survey by the Commerce Development Research Institute on the demand in emerging markets for quality and price competitive products suggests that about 65% of the middle-class households in India have water purifiers or relevant machines. The market for water purification equipment has unlimited potential and business opportunities.

11.3 Growth and forecasts of the water purifiers market in India

According to the report “Forecasts and Opportunities for Global Water Purifiers: 2018”, the market size increased at a CAGR of about 10% in 2013-2018. The Indian market is poised to become the biggest in Asia Pacific given its population and poor quality of drinking water.

11.4 Market and forecasts for commercial-grade water purifiers market

The outlook for commercial-grade water purifiers market is also optimistic. The report “Global Industrial Water Purifier Market 2017-2021” forecasts a CAGR of 5.68% for the market in 2017-2021. The Indian market is expected to show a CAGR of 25% of these five years, higher than the average growth in the world. The Indian market is set to become an important market, next only to China.

11.5 Main products in the India market

There are three mainstream types of water purifiers in the India market:

UV disinfection water purifiers

RO water purifiers

Chemical-based water purifiers

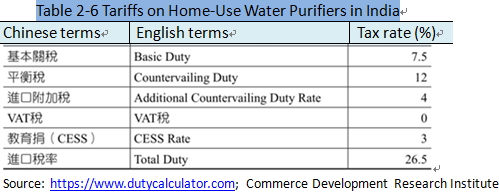

11.6 Tariffs on water purifications in India

The Indian government imposes four duties on water purifiers, at a total tax rate of 26.5% (detailed in the table below).

11.7 Certifications and standards in the Indian market

Each government typically sets its own standards for drinking water. The Indian government has formulated the standards called BIS Standards (BIS = Bureau of Indian Standards).

The two popular inspection standards in India are NSF certificates, and WQA gold seals.

11.8 Internet penetration in India

The size of Internet users in India is the second largest in the world, following China’s 650 million. According to 2019 Internet Trends Report, the Internet coverage in India is 12%. India has the world’s second largest Internet population, next to China (21% penetration).

11.9 Channels for purchase of water purifiers in India

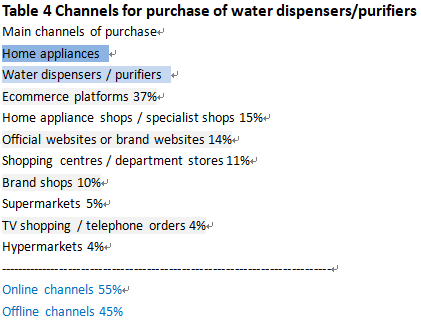

The results of the questionnaire survey below show that online shopping exceeds brick-and-mortar channels by 10% for the water purifiers market in India.

Sample for water dispensers / purifiers: No. of interviewers (744)

Q158: Where do your purchase water dispensers / purifiers? (one option only)

Data source:

https://www.taiwanexcellence.org/upload/uploads/files/nelson/108_India_U&A.pdf#page30

11.10 Major ecommerce platforms in India:

UrbanClap

Infibeam

Infoedge

BookMyShow

Yatra

11.11 SWOT analysis of the Indian market for water purification equipment

11.12 Popular brands in India

Foreign brands

A.O. Smith, HUL PureIt(Unilever),Culligan,

Domestic brands:

Royal Aquafresh , TATA Swach, Eureka Forbes, AMPEREUS,KENT, Ruby, Lukzer, Grand Plus, Voltas, Butterfly, Prestige, Subtle Selection, Konquer TimeS,WaterScience, Watamate,Aqua Grand+, Generic , ORILEY, NAMIBIND, Konvio Neer, Eco365, Chirag, Elegant Casa, KRPLUS, AQUA DOVE, DE Fresh Aqua, Konka, Glassiano,

12) Japan

12.1 Development of the water purification equipment market in Japan

The global market for water resources in 2013 totalled US$53.9 billion, and Japanese companies only accounted for 3% or US$1.51 billion. The top five products are membranes, materials, parts & equipment; Plant Engineering; Operation and Maintenance (O&M) and Supervisory Control & Data Acquisition (SCADA).

In 2015, the number of water purifiers sold totalled 318,400 units, and the number of filters distributed was 23.73 million in Japan. The breakdown of the 318,400 units by product type is as follows:

1 Faucet water purifiers 56%

2 Under counter models 23%

3 Water filter jugs 16%

4 Desktop water purifiers 5%。

12.2 Penetration of water purifiers in Japan

Japan boasts one of the highest penetration rates of water purifiers in the world. The household penetration is as high as 40.5%.

Below is the list of penetration rates in terms of city/town sizes.

1. Metropolitans: 43.4%

2. Towns with more than 150,000 people: 42.2%。

3. Towns with less than 150,000 people:38.0%。

4. County townships: 34.3%。

12.3 Considerations for Japanese consumers in the selection of water purifiers

A survey by the Japan Water Purification Association (JWPA) indicates that most people consider the following factors for the purchase of water purifiers.

- Filtering functions 46.0%

- Removal of hazardous substances 29.1%

- Simple installation 27.3%

- Unit prices 24.9%

- Filter prices 19.4%

- Filter replacement cycles 18.5%

- Design/look 12.6%

- Size 11.5%

- Maintenance of filters 11.0%

- After-sale services 6.6%

- Water consumption efficiency 4.6%

The U.S. is the biggest country of origin for water purifiers imported by Japan. U.S. purifiers account for 28.7% of the total import value, followed by those from China and Korea.

Japanese companies place some low-volume, large-variety orders for components with Taiwan. Partly due to limited volumes and robust quality requirements, Japanese clients usually are willing to pay higher unit prices. Most of the orders from Japan are for components and filters of RO purifiers.

12.4 Popular brands in Japan

Domestic brands:

Cleansui, Toray, Panasonic, Meisui, Samodora, Aquverse, LIXIL(Inax), TOTO, FORESTWATER, Vitdam, Kitz, ZOJIRUSHI,SANEI

Foreign brands:

HYDROBLU(USA), Sawyer (USA), Brita,Pentair

VII. Conclusions

COVID-19 is still wreaking havoc around the world. A total of 229 countries have confirmed diagnoses, and the total number of confirmed cases exceeds 23 million. More than 800,000 people have died. In China, weeks of pouring rain has caused flooding in the mid to downstream of the Yangtze River. In Japan, the heavy rains in Kumamoto-ken and Kagoshima ken of Kyushu resulted in floods and mudslides in July 2020. On August 8, the torrent rains in Korea caused 21 deaths and 11 people missing. The level of warnings for landslides was raised to the highest.

The year 2020 is full of disasters around the world. Water companies suffer contamination in water sources and pipes due to floods. Rivers are also polluted. The water purification equipment companies saw a dramatic decline in orders in the second quarter but received more orders than they could handle in the third quarters. The demand for home-use water purifiers is set to rise further after the pandemic and floods.

Finally, the author summarizes the 12 countries mentioned in this report in the following table, for easy references by readers. The table below includes the population, market size, popular brands (foreign and domestic), export/import values and countries of origin of water purification equipment.

|

Brands in individual markets |

|||||

|

Country |

Population (mn) |

Market size (unit: US$m) |

Popular brands |

Import/export and value (unit: US$m) |

|

|

Domestic brands |

Foreign brands |

||||

|

Turkey |

78 |

1,100 |

Hazar/ESLİ / Frizzlife/ Express / Simpure/ Home Master/ Brondell Circle / FS-TFC / Aquatic/ Rinkmo/ Geekpure/ Hydro-Logic/ PUCRT/Genuine/ Yescom/ AquaLutio/ |

Brita / Whirlpool/ RKIN / iSpring / Aquasana /Watts/ AUGIENB/ LYUMO /Brio / aibileec /Pur / CuZn / LEVOIT / Culligan / GE /LAKE,ESOW / Pure Source / Samsung / AO Smith |

|

|

US |

328 |

1,300 |

ZeroWater /Pur/ Frizzlife/ Nakii / Apec / Glacial Pure / Waterdrop / Aquagear/ Berkey/ EpicWater / Aquabliss / Reshape / MaxStrength Pro / Brio / GE / LEVOIT/Everpure / Aquaboon/ Hskyhan/ExpressWater/ Cuzn /Whirlpool Bosnell /Mountain Flow / Crystala Filters/Santevia/ Culligan / Amway / Tupperware |

Samsung / LG /BWT /Dew Filters / Aquacrest /LifeStraw /EcoSmart / Wingsol /Katadyn /Brita |

Import (2019): Export (2019): Source: |

|

Spain |

47 |

1,100 |

Tapp/ Spardar/ YJHome/ Osairous/ Ecopure/Waterdrop/Goeco/WinArrow/Bestever/ H2O Taps/Aqua Optima /Slickbox/ Rowenta/Newdora/ PowerDoF/ TM Electron / Orinko/ filterportal/ iWater/ Ghonlzin / Bestever/ / Desconocido / GRIFEMA / Cadrim /XREXS / Bbagua / RUNACC /ADOVEL/ BETOY/GXHGRASS/Aigostar/ CANALETAS/SILBERTHAL/Finerfilters / Haofy /Fdit/ Czxwyst/ AIMIUVEI/ KURO-Bō / Nrpfell/ Enzege/ CREA/ Vibratis |

Brita / Geyser(Russian) / Waterdrop(UK) / BWT /Boston Tech (USA) / AEG(Germany) / Aquaphor(Russian) / LaVie(France) / MAURER(UK) /baytiz(UK) |

Import (2016): Source: Trade Insight |

|

Iran |

83 |

40,000 |

UltraJet /MaxTec/ Salamat Gostar Warsh /PureLine(SahandIndustries ) / Aqua blue / Violet / Soft Water / Tasfieh Sazan Mehr |

BOSCH /ALYA (Taiwan)/ Puricom (Taiwan) /Aqua Spring (Taiwan)/ Takoman (Vietnam) /AquaPro (Taiwan) /AquaSol(Demark)/AquaSpring / Sole Aqua ) / AquaBlue (Egypt) /Aqualife (US) |

|

|

Egypt |

100 |

5 |

Maxsome/ Tango / Tank Power/ Zoosen / Hi Tech /Aqua Jet / Aqua Trex / Soul Water/ Lockk & Lock /Generic / Universal/ Moma /Blu/ Uno / Konka |

Panasonic/ Brita / Culligan / Sprite / CCK / FreshWater (UK) |

|

|

Malaysia |

32 |

800 |

Nesh/ Diamond / Seiketsu /Joven /Aquaman / waterman/ Filterman/ Instar-life /AMG / MDBC |

Doulton /Panasonic/ 3M/ Coway/ |

|

|

China |

1,400 |

18,400 |

Angel/ Midea/ Haier/ Litree/ Qlife/ Xiaomi/ Canature/ Hunsdon/ TRULIVA/ Sun Rain/ GREE/ TCL/ KEMFLO/ Joyoung |

3M/ Everpure/AO Smith/ BWT/ |

Import by percentage (2015): Source: Trade Insight |

|

Vietnam |

96 |

250 |

Tecomen/Tana/Sonha/KoriHome/Comath/Kangaroo/Karofi /Eurolife / Goodlife/ NanoRobo/ Sunhouse /Geyser/ Fujie / Nagakawa /Vasstar/ Pureworld / Aqua |

AO Smith /Coway/Xiaomi/ |

|

|

Taiwan |

23 |

160 |

ALYA/ CHANSON/ Water Nice/ ACUO/Great Idea/ Yen Sun Technology/ Sakura/ Buder/ Hao Hsing (with own factories, channels, and brands) |

3M/Everpure/AO Smith/ BWT/ Coway/ Brita/ Doulton/ Philips/ Panasonic/Toray/ Amway/ Mitsubishi/ Franke/Pureit/ Laica /LG /GE /Honeywell / Lux/ Watpure/Toppuror /小米 |

Import (2019): Export (2019): Source: Bureau of Foreign Trade |

|

Korea |

51 |

1,700 |

Pureal/ Sejin Aqua/ Waterpia/ Claro/Ruhens/Hyundai/Wonbong /Filtertech /Wells/ LG/ Okwater/Coway/COMS/OKO/KC/ICEVAN /Cuckoo/ SK Magic |

Brita/ Everpure/ 3M /Laica/ Calligan/BWT/ Philips/Jet soda stream (Israel) |

|

|

India |

1,340 |

1,500 |

Royal Aquafresh /TATA Swach/ EurekaForbes/AMPEREUS/KENT/ Ruby/ Lukzer/ Grand Plus/ Voltas/Butterfly/Prestige/ Subtle Selection/Konquer TimeS/WaterScience/Watamate/ Aqua Grand+/ Generic / ORILEY/ NAMIBIND/ Konvio Neer/ Eco365/ Chirag/ Elegant Casa/ KRPLUS/ AQUA DOVE/ DE Fresh Aqua/ Konka/ Glassiano |

A.O. Smith/ HUL PureIt (Unilever) |

|

|

Japan |

126 |

150 |

Cleansui / Toray/ Panasonic/ Meisui/ Samodora/ Aquverse/ LIXIL(Inax)/ TOTO / FORESTWATER / Vitdam / Kitz/ ZOJIRUSHI/SANEI |

3M/ COWAY/EVERPURE/ PHILIPS/ |

Import (2016): |

Sources:

https://ppt.cc/f42qax

Recommended reading:

Global Top 10 OEM/ODM Manufacturers for Home-Use Water Purifiers in 2020

https://ppt.cc/fILbjx

References:

Taipei Economic & Cultural Office in Vietnam

https://ppt.cc/fxHvwx

Nikkei

https://reurl.cc/V6WxZ

CNYes

https://reurl.cc/g7r8NQ

Trade Insight No. 466

https://ppt.cc/fEl5Ox

Business Opportunities in China and Vietnam in Relation to Water and Air Quality for Homes

Commerce Development Research Institute

Business Weekly

https://ppt.cc/fRGejx

Bureau of Foreign Trade, Ministry of Economic Affairs

Easywell Water Systems Inc.

https://ppt.cc/f78tTx

EX/IM Club

https://ppt.cc/f136wx

KK News

https://ppt.cc/fvAS9x

Taiwan Excellence Award

https://ppt.cc/f6IKGx

Materials Net

https://ppt.cc/fjW1yx

Economic Daily, Taiwan

2020 08 10

Content of this article is free to use, but please attribute the source.

Author: Rodger Lin, Alya Water / Easywell Water Systems Inc.